This newsletter will discuss the concern that many homeowners and buyers have about investing in real estate: what if the value of my house no longer covers my mortgage due to a recession?

This is a perfectly reasonable concern to have when making the decision to invest in real estate. Home prices have tanked before, right? However, let’s break down what a recession really is. Similarly, let’s get an understanding of what you can expect from your typical recession as a consumer.

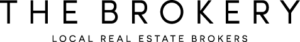

A recession is defined as a decline in GDP (gross domestic product) for two consecutive quarters during the year. Basically, GDP is an indication of how well our economy is doing as a whole. GDP has an upward trend historically and the housing market only accounts for roughly 4% of the United States’ overall GDP. In a very general sense, the growth of our GDP is a reflection of how much money people are making and how many people have jobs. Inversely, a negative period of GDP will typically be accompanied by an uptick in unemployment.

The graph below will give you a sense of the correlation between our GDP and unemployment rate during our past 4 recessions.

But let’s get back to the topic at hand here: what happens to housing prices during a recession?

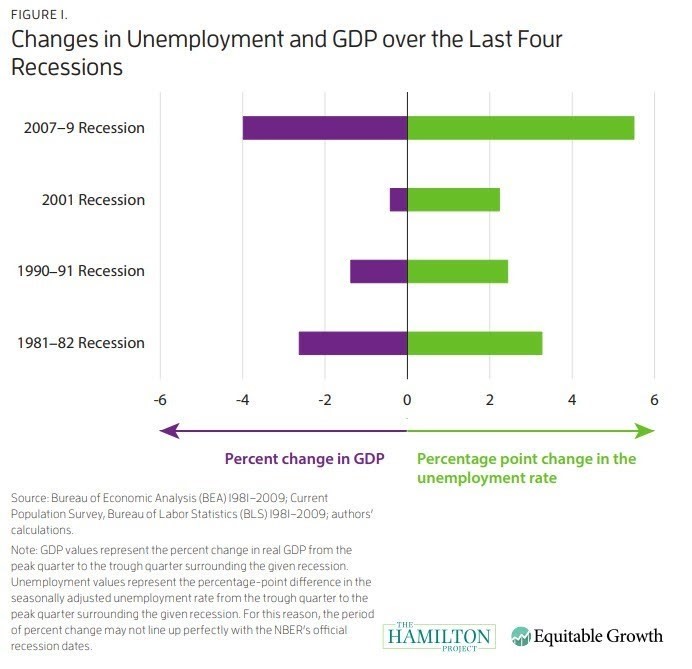

The short answer is that the housing market isn’t always affected negatively by a recession. Like I said above, the housing sector only makes up roughly 4% of the entire economic picture (GDP). In fact, housing prices have only deflated in two out of the last five recessions.

Take a look at this chart to see how previous recessions have affected housing prices. These numbers only reflect the timeframe during the recession. Notice the extreme difference in housing deflation between the 1990 and 2007 recessions.

Our last recession in 2007-09 is now referred to as “The Great Recession” because of how significantly it affected people. Many people lost their jobs and their homes which caused foreclosure sales to skyrocket. Not only did we have the largest shift in home prices during the recession, but housing prices continued to spiral out of control even after our GDP had begun to show signs of life. As far as recessions go, The Great Recession was a housing market outlier.

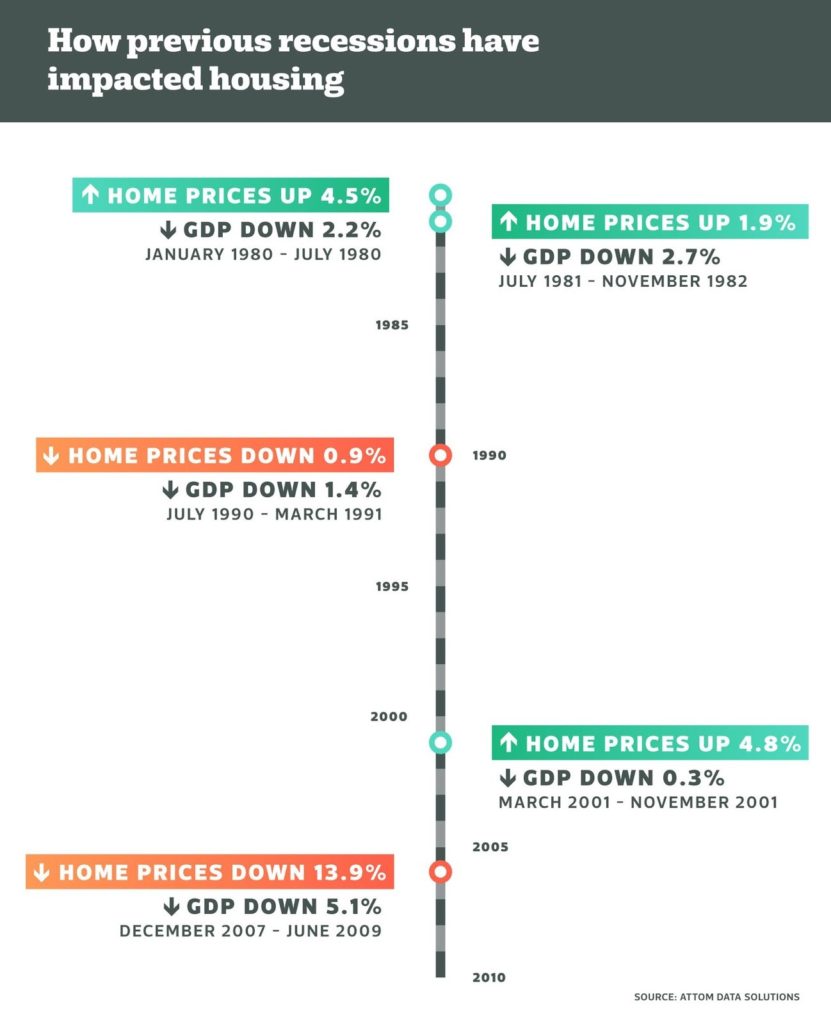

This next graphic will show you how our past 5 recessions have affected housing prices on average across the entire country. The shaded areas indicate the time frame of the recession and the red line indicates a simple inflation of housing prices at a rate of 3% annually. You’ll see that the only recession to crash home prices was The Great Recession while the other recessions did not significantly impact the housing market.

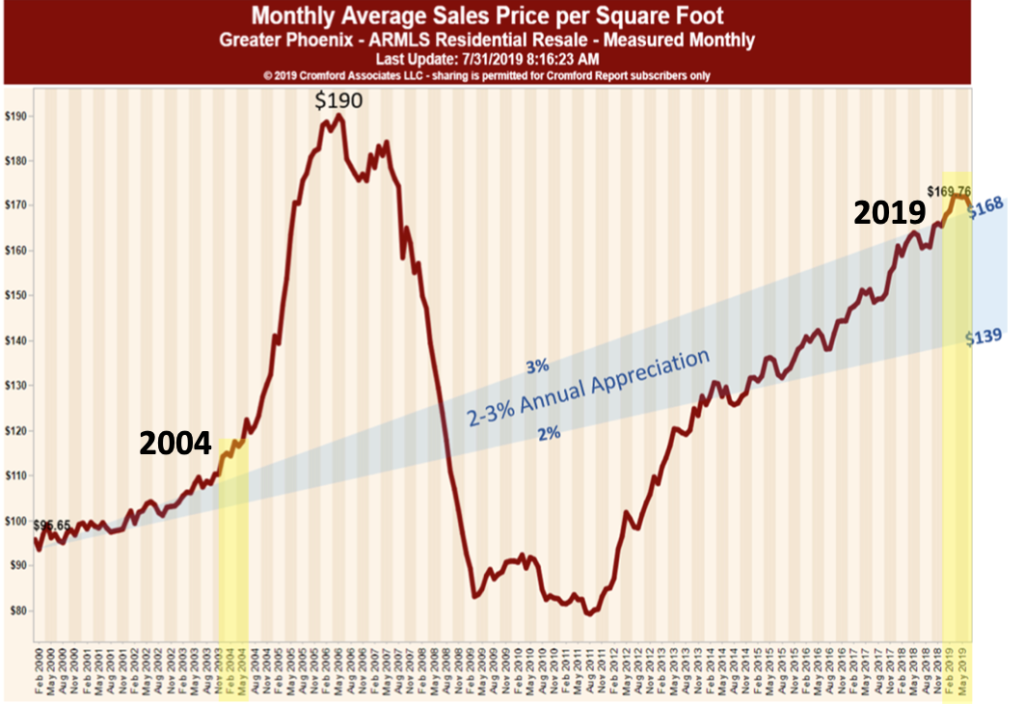

Today, housing prices are exactly where they should be. Phoenix isn’t in a housing bubble. I’ll leave you with this last graphic. Even though I don’t like using price per square foot to justify pricing, I’ll make an exception here.

Let’s say that housing prices appreciated a modest 2-3% per year since before the housing boom and trough of The Great Recession. It would look a little something like this; exactly where our prices are now.

Sources: Blinder, Alan S. After the Music Stopped: The Financial Crisis, the Response, and the Work Ahead. New York: Penguin Press, 2013. (Pg. 18) Fig 1 : Bureau of Economic Analysis | Fig 2: Attom Data Solutions | Fig 3: U.S. National Home Price Index | Fig 4: The Cromford Report

As your real estate professional, I pride myself on being here to provide you with all of the tools and knowledge you need to succeed in the real estate market. Reach out any time.

Oh, by the way®… if you know of someone who would appreciate the level of service I provide, please call me with their name and contact information. I’ll be happy to follow up and take great care of them.

If you have any questions, please reach out to me. I’m always happy to help!